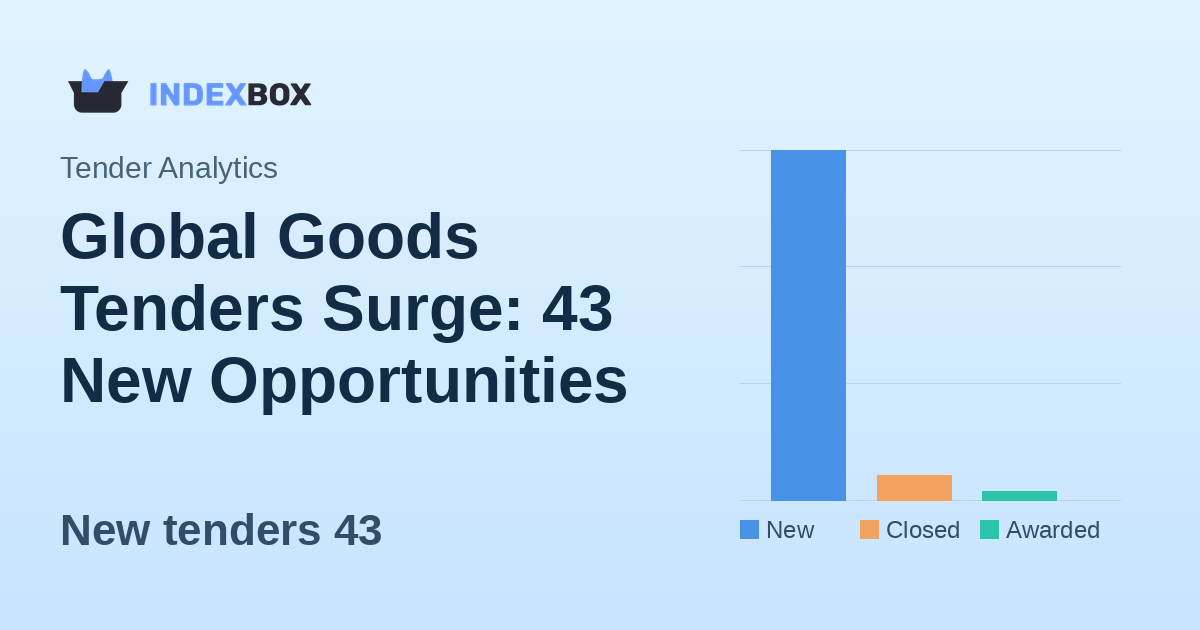

The global Goods procurement market saw significant activity on February 9, 2026, with 43 new tenders published, valued at over $245,000 USD. South Africa and Pakistan dominated the landscape, accounting for the majority of new opportunities. While only one contract was awarded, the high volume of new tenders and an average bid window of nearly 12 days indicate a dynamic and accessible market for suppliers.

New tenders43

Closed tenders3

Awarded tenders1

Bid window11.8 days

COMPULINK TECHNOLOGIES INC (260 W 39th St)

1

Repeat winners to benchmark or partner with.

South Africa

Pakistan

United Kingdom

United States

Goods

Miscellaneous

Civil Goods

Furniture/Fixture

Full analysis

Market Overview: A High-Volume Day for Goods Procurement

February 9, 2026, marked a day of substantial activity in the global Goods procurement category. A total of 43 new tender opportunities were published, representing a significant influx for suppliers worldwide. The combined estimated value of these new solicitations stands at $245,298.07 USD, signaling robust public sector demand across various goods segments.

In contrast to the high volume of new opportunities, contract closures and awards were limited. Only three tenders were closed, and a single contract was awarded on this date. The awarded contract had a value of $63,285.00 USD. This disparity between new publications and awards highlights the ongoing pipeline of opportunities, with many tenders still in the bidding or evaluation phase.

The data underscores a vibrant and active Goods procurement environment. The significant new tender value, nearly four times the value of the single award, suggests governments and public bodies are actively sourcing a wide range of goods, creating a competitive landscape for vendors seeking new public sector contracts.

Geographic and Sector Analysis: South Africa and Pakistan Lead

Geographic analysis reveals a highly concentrated market on February 9th. South Africa was the most active country by a significant margin, issuing 26 of the 43 new Goods tenders. Pakistan followed as the second most active nation, publishing 13 new opportunities. Together, these two countries accounted for 90% of all new Goods tenders published globally on this date.

The United Kingdom and the United States also contributed to the day’s activity, with 3 and 1 new tenders respectively. This concentration indicates where suppliers should focus their business development and monitoring efforts in the immediate term. The dominance of South Africa and Pakistan points to specific regional procurement cycles or project initiations driving the global tally.

Within the overarching ‘Goods’ category, the data shows subsidiary sector activity. ‘Miscellaneous’ goods accounted for 5 tenders, ‘Civil Goods’ for 2, and ‘Furniture/Fixture’ and ‘Printing’ for 1 tender each. This distribution confirms that the day’s activity, while categorized broadly as Goods, encompassed a diverse range of specific product needs from various public entities.

- South Africa: 26 new tenders (60% of global total).

- Pakistan: 13 new tenders (30% of global total).

- United Kingdom: 3 new tenders.

- United States: 1 new tender.

Bidder Insights: Award Details and Strategic Timing

Procurement analytics for February 9th provide clear insights for bidders. The sole contract award went to COMPULINK TECHNOLOGIES INC (260 W 39th St). This award, valued at $63,285.00 USD, demonstrates successful market entry and contract capture within the Goods category.

A critical metric for suppliers is the average bid window, which stood at 11.78 days for the new tenders published. This provides a clear timeline for action. An average of nearly 12 days from publication to deadline is a reasonable window for preparing quality bids, but it necessitates prompt attention and efficient proposal processes. Suppliers must quickly assess opportunities, gather documentation, and submit compliant bids within this timeframe to compete effectively.

The presence of only one identified winner against 43 new opportunities reinforces the competitive nature of public procurement. It emphasizes the need for suppliers to not only track new publications but also to analyze award patterns and understand evaluator preferences to improve their future success rates.

Actionable Procurement Intelligence for Suppliers

For suppliers targeting the Goods category, the data from February 9, 2026, presents a clear call to action. The high volume of new tenders, particularly from South Africa and Pakistan, represents immediate opportunities. Firms with capabilities and interest in these markets should prioritize monitoring tender portals in these regions.

The average bid window of 11.78 days is a double-edged sword; it allows time for preparation but requires swift mobilization. Companies should have standardized bid preparation processes to efficiently respond within this typical period. The concentration of opportunities also suggests that establishing a local presence or partnership in the leading countries could be a strategic advantage.

Finally, while the award activity was low on this specific day, tracking winners like COMPULINK TECHNOLOGIES INC provides valuable market intelligence. Understanding who is winning contracts, and for what types of goods, can inform competitive positioning and partnership strategies. Suppliers should use this daily data to identify trends, prioritize resources, and strategically time their bid submissions in the active Goods procurement landscape.

- Prioritize monitoring and bidding on opportunities from South Africa and Pakistan.

- Mobilize bid teams quickly to meet the ~12-day average response window.

- Analyze sector breakdown (Miscellaneous, Civil Goods, etc.) to align with your product offerings.

- Use award data to understand competitor activity and market valuation.

Related tenders

Source: https://www.indexbox.io/blog/tenders-2026-02-09-tender-analytics-goods/

.