The Request for Bid (ELWS/2024/71) for the procurement of personnel carriers for the SA Army was issued on 23 July 2024, with a requirement for 462 vehicles. This Request for Bid followed the initial Request for Information (RFI/01/2023) for armoured personnel carrier vehicles capable of counterinsurgency operations.

This is an exciting development for providing locally produced solutions for the market. The problem is that there have been too many changes in approach since the issuing of the RFI. It makes industry wonder if the Handbook for the Acquisition of Armaments in the Department of Defence and in Armscor (DAHB 1000) has been followed. The Required Operational Capability would have been completed. The definition phase with the Staff Target that guides the Functional Study, which gives the output of a Staff Requirement would have been captured prior to entering the rest of the procurement process. Project Study Report has earmarked a buy decision. The buy decision is for existing Off-The-Shelf products with minor modifications to achieve specification. The specification of the end user is generally captured at this stage in the Functional User Requirement Specification (FURS). This process is signed off by the Operations Staff Council for recommendation by the Military Command Council. This guides procurement requirements and Armscor then generates a procurement specification based on the FURS.

The confusion started with the RFI mentioning different levels of protection. Firstly, paragraph 3.1.1 states minimum 7.62 x 51 mm ball ballistic protection and Level 1 blast protection, followed by second requirement 5.2.1.2 & 3 that “shall be used as a guideline” that mentioned protection against 7.62 x 51 mm and 5.56 mm ball ammunition and protection against a single 8 kg surrogate mine (Level 3 blast) placed under the vehicle. The mine protection was subsequently reduced to Level 1 (only against hand grenades).

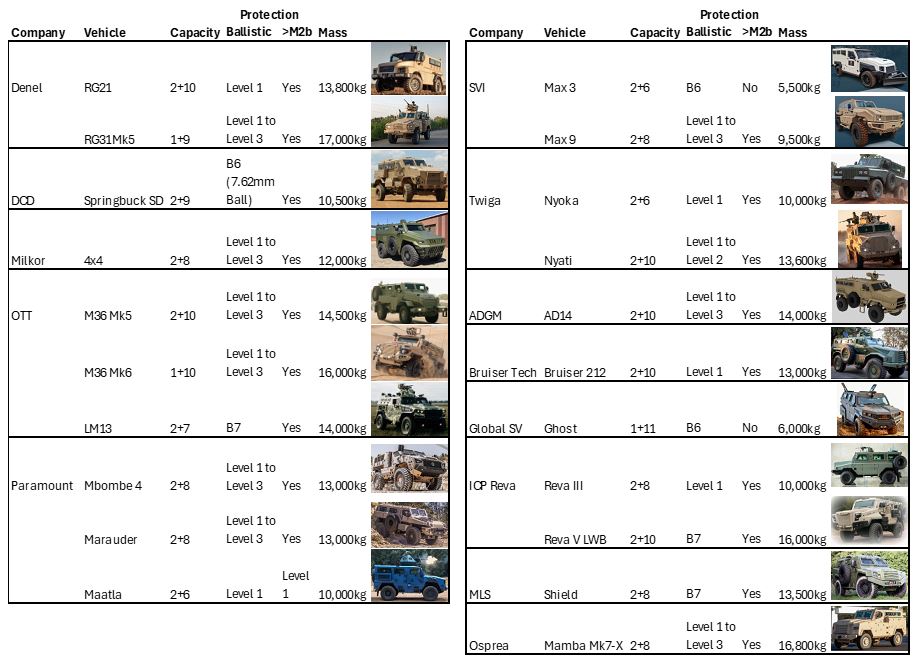

The standard APC configuration in the RFI aligned with the South African defence industry (SADI) accepted norm of 10 crew members (generally 2+8 seating configuration), with the option for variant configurations of Section, Command and Ambulance variants.

Many Military-Off-The-Shelf (MOTS) solutions were options that could satisfy the differing range of protection mentioned in the RFI. Below are some vehicles by local entities that meet the various descriptions of APC for counterinsurgency operations.

The confusion has been extended in the RFP process.

The specification has called for the RFI minimum 7.62mm x 51mm ball ballistic protection and no blast protection. There was then an additional change in configuration to have a minimum of 11 crew with 10 seats in the rear crew compartment of the Section Variant. This effectively requires a 2+10 seat configuration, but also asks for all patrol equipment and personal kit for 72-hour operations to be carried inside the vehicle, not in storage bins as per the RFI. A further development captured in the RFP is that the vehicle is to have a 13.5 ton Gross Vehicle Mass, while catering for a minimum payload of 1.5 tons.

The RFP was issued on 23 July 2024 with a bid submission date one month later of 23 August 2024. A bidder’s conference was held on 8 August 2024 (initial date was 31 July 2024).

The answers to questions raised leading into the bidder’s conference were only answered on 21 August 2024, just two days before submission. On this date, an extension was granted by Armscor for submission of bids to 13 September 2024. The problem is that the answers to the questions have significantly changed the vehicle system requirements.

The ballistic protection has effectively been increased to “full” STANAG Level 1 protection that covers 7.62 x 51 mm and 5.56 mm ball ammunition. Not just the 7.62 x 51 mm ball ammunition of the RFP Specification. Even more importantly, the mine blast protection was changed to a Level 2 blast (single 6 kg surrogate mine placed under the vehicle) versus the RFP specification mentioning NO mine blast protection, and then down to Level 1. These two changes have a significant mass impact, but also eliminate some potential supplier solutions. I am thinking of the competitive Paramount Maatla in a Long Wheel Base as an example of how the changes to requirements can cause bidders to restart documentation, or even change the solution being offered, or in the worst case decide on a no bid due to a now non-compliant solution.

Of less consequence is that the decision to allow a crew member to sit in the open front seat, thus changing the configuration to 2+9 seat. This could aid in fitting the equipment to be fitted in the vehicle. As example, the radios must be mounted behind the driver, using seat space.

The changes are significant. If a MOTS vehicle needs to be modified to achieve the specification, then in reality the mine blast certification would have to be conducted again. This adds significant overhead to a product in terms of time and cost to initial delivery.

At what point does a change of specification imply that a tender needs to be retracted? There is hope that the submission would not have to be redone by suppliers due to a future challenge of any contract award. Think of the VISTULA programme that was challenged. The impact is that the SANDF still does not have a replacement for the SAMIL support vehicle fleet 20 years later.

The reality of the time for placing orders and the potential of industry to deliver complex systems is also in question. The process of acquisition is well specified in DAHB-1000. The Personnel Carrier approval will be at the highest level of the Armaments Acquisition Council (AAC) that is chaired by the Minister of Defence & Military Veterans. Delays in the approval process are well known. As examples, the pilot rescue vehicle tender (ELWS/2023/39) that was posted on 26 September 2023 with a validity of 365 days has requested bidders for extension to 31 March 2025. The really urgent 6×6 vehicle tender (EWSD/2024/18) published on 14 May 2024 that was going to be delivered for testing by 31 July 2024 has requested bidders for an extension to 31 October 2024.

Now the Personnel Carrier tender has set stretch targets for industry to submit a proposal for a complex system. Keep in mind that the previous timelines related to a complex RFP would generally be minimum three months to submission. The last large complex vehicle programme RFPs of similar stature (VISTULA and HOEFYSTER) had a one-year timeframe for submission. It is as if the defence industry is being punished for delays in the internal acquisition process. If the original Armscor tender is correct, then an order should have been placed from 1 April 2024. The RFP was only issued in July 2024.

The delivery dates are also a stretch. The first article vehicles of each variant are required two months after receipt of order for entering testing. According to the DAHB 1000, these would establish a manufacturing baseline after testing. Then 20 of each variant is required by 15 March 2025. This is 60 vehicles. A question would be why Armscor does not specify the 82 vehicles needed to cover the first deployed battalion. The vehicle supply of 60, or 82 vehicles, would be a challenge unless the vehicles are in stock. If not in stock, then a realistic timeline based on long lead items would be 12 months for the initial 60 vehicles. The remaining portion of the 462 vehicles with the logistics and support deliverables are required by a realistic 15 March 2028.

The earliest AAC would be at the beginning of December 2024 or end January 2025. Keep in mind that there are at least three other approval levels to be navigated prior to submitting the information to an AAC. The AAC also needs the information at least two weeks in advance of a meeting. The examples used above indicate that this is stretch. The tender validity of 180 days is more realistic, but still tight. So, the revised dates are interesting and raise questions on the validity of the tender process.

Is all well at Armscor?

Written by James Kerr, Orion Consulting CC, which provides Market Entry Strategy and Bid & Proposal services to the Aerospace & Defence related industry and assists international SME mission system product suppliers to gain traction in South Africa.

Source: https://www.defenceweb.co.za/featured/personnel-carrier-tender-is-all-well-at-armscor/

.