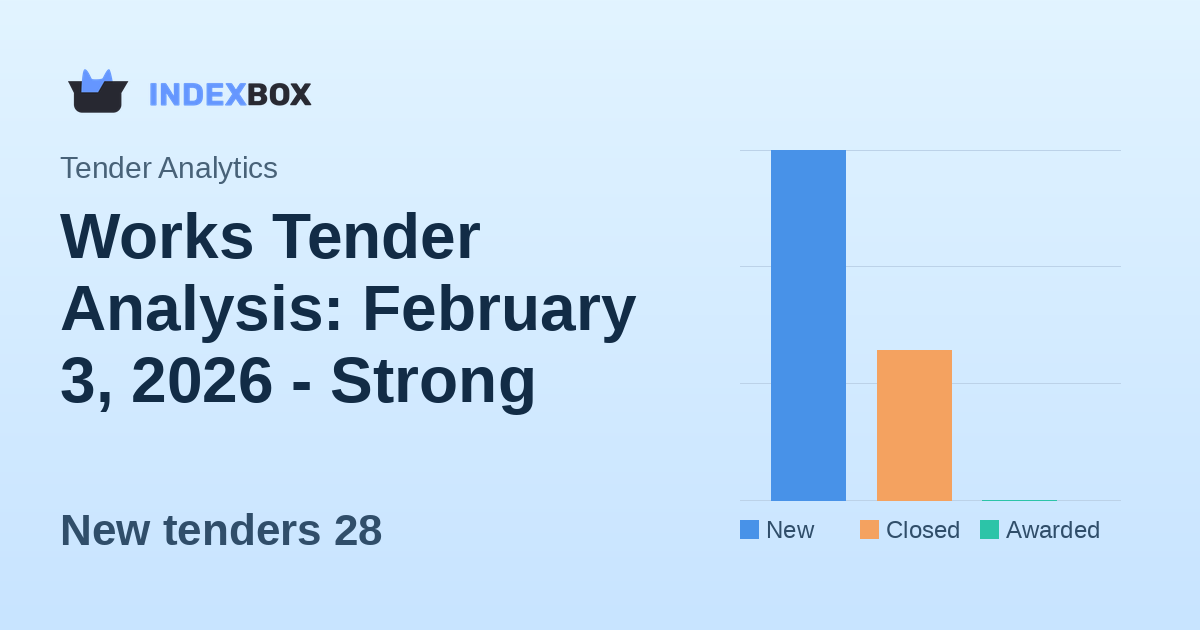

The Works procurement category showed robust activity on February 3, 2026, with 28 new tenders announced and 12 closed, though no awards were finalized. The total new tender value exceeded $2 million USD, with the United Kingdom and South Africa dominating the market. The average bid window remains tight at approximately 15 days, indicating a fast-paced procurement environment for construction and infrastructure projects.

New tenders28

Closed tenders12

Awarded tenders0

Bid window14.7 days

United Kingdom

South Africa

United States

Works

Full analysis

Daily Works Tender Overview: February 3, 2026

The Works procurement category demonstrated significant activity on February 3, 2026, with 28 new tenders announced globally. This represents a substantial volume of new opportunities in construction, infrastructure, and related project-based contracting. Alongside these new announcements, 12 tenders were closed, indicating ongoing procurement cycles within the sector.

A notable aspect of the day’s data is the absence of any awarded tenders, with the awarded value remaining null. This suggests that while new projects are entering the pipeline and existing ones are closing for bids, final contract awards are either pending or were not processed on this specific date. The total value of newly announced Works tenders reached $2,009,362.94 USD, highlighting the considerable financial scale of projects currently being sourced.

The data reflects a dynamic procurement environment where opportunities are emerging rapidly, but the final award phase may involve longer evaluation periods or occur in batches on different reporting days. For contractors and suppliers, this underscores the importance of monitoring daily tender releases closely to capture new opportunities as they arise.

- 28 new Works tenders announced

- 12 tenders closed on the same day

- 0 tenders awarded, with null awarded value

- Total new tender value: $2,009,362.94 USD

Geographic Distribution and Market Leaders

The geographic distribution of Works tenders on February 3, 2026, was heavily concentrated, with the United Kingdom and South Africa emerging as the dominant markets. The United Kingdom led with 17 tenders, representing over 60% of the day’s total new activity in the Works category. South Africa followed with 10 tenders, indicating strong procurement momentum in its infrastructure and construction sectors.

The United States appeared with a single tender, showing minimal activity relative to the other leading countries. This concentration suggests that procurement activity in the Works sector can be highly regionalized on a daily basis, with specific national or local governments driving bulk tender releases.

For international contractors and suppliers, this distribution highlights key active markets. The United Kingdom’s high volume suggests ongoing public or private investment in construction projects, while South Africa’s significant presence points to substantial infrastructure development initiatives. Companies with operations or partnerships in these regions are particularly well-positioned to respond to these opportunities.

- United Kingdom: 17 tenders (Market Leader)

- South Africa: 10 tenders

- United States: 1 tender

- Top two countries accounted for 27 of the 28 new tenders

Bid Window Analysis and Submission Timelines

The average bid window for Works tenders on February 3, 2026, stood at 14.69 days, or approximately 15 days. This metric, calculated from the provided data, indicates the typical time potential bidders have between a tender’s announcement and its submission deadline. A window of roughly two weeks is considered relatively tight in the procurement world, especially for complex Works projects that often require detailed proposals, cost estimations, and technical plans.

This compressed timeline places pressure on contractors and suppliers to prepare bids efficiently. It necessitates having readily available company documentation, financial records, and technical capabilities to assemble competitive proposals quickly. For larger, more complex infrastructure projects, a 15-day window may challenge firms without streamlined bid preparation processes.

The consistent average across the day’s tenders suggests that procuring entities in the Works sector are operating with standardized timelines, possibly driven by regulatory frameworks or internal procurement policies. Bidders must factor this short window into their business development strategies, potentially requiring dedicated teams to monitor and respond to opportunities rapidly to avoid missing deadlines.

- Average bid window: 14.69 days

- Implies a fast-paced submission environment

- Requires efficient bid preparation processes

- May standardize response timelines across different projects

Sector Concentration and Procurement Implications

The sector data reveals an exclusive focus on the ‘Works’ category itself, with all 28 new tenders classified under this broad heading. This indicates that the reported activity is purely for construction, repair, maintenance, and civil engineering projects, without spillover into adjacent categories like goods or services on this specific date. Such concentration allows for a clear analysis of trends within the infrastructure and building sector.

The absence of awarded tenders and winners’ data for February 3, 2026, limits insights into which companies are currently successful in securing Works contracts. However, the high volume of new and closed tenders confirms that the procurement pipeline is active. The next phase to watch will be the award notices, which will reveal the successful bidders and provide insights into market competitiveness and pricing.

For procurement professionals and contractors, this data emphasizes the sheer volume of opportunities within the Works sector. The combination of high new tender count, significant total value, and active closures suggests a healthy, flowing market. Stakeholders should prepare for potential award announcements in the coming days, which will follow the current cycle of closures.

- 100% of new tenders were in the ‘Works’ sector

- No awarded tenders or winner data reported

- Confirms a focused analysis on construction and infrastructure

- Highlights an active procurement pipeline awaiting award decisions

Explore tenders

Source: https://www.indexbox.io/blog/tenders-2026-02-03-tender-analytics-works/

.